ONLINE BANKING

PRODUCTS & SERVICES

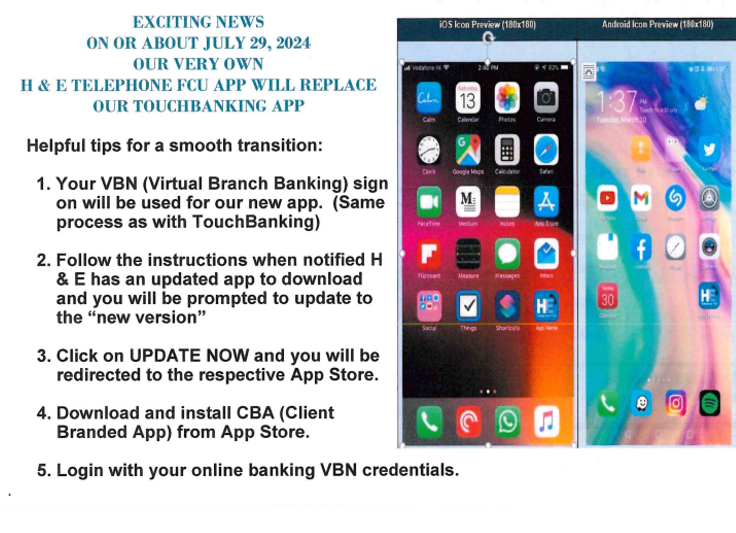

MOBILE APP

LOans

Loans

- Consumer Loans

- Real Estate Loans

- New automobile Loans

- Used automobile Loans

- Holiday Loans

- Loan Policies

Insured Savings and Certificates

The NCUSIF is widely recognized as the best managed of all federal deposit insurance funds, better than the programs that insure banks or savings and loans.

H & E requires a $25 minimum to maintain a savings account. Interest is paid on all balances above $50. H & E attempts to pay rates above average rates at banks, and rates are examined and may be changed quarterly. Interest is compounded daily and credited quarterly to accounts on January 1, April 1, July 1 and October 1.

Share Certificate Accounts are issued in a minimum of $1000. H & E offers 6 month and 12 month Share Certificates with interest compounding daily and posting quarterly. Our 2 year and 3 year Share Certificates pay simple interest posted at maturity.

Checking Accounts

H & E Checking accounts feature:

- No monthly service fees

- No per-check charge

- No minimum balance

- Interest on balances over $100

- Free overdraft transfers from savings

- Direct deposit

- Monthly statements

- 24 hour access through ATM cards and H & E ARS telephone system

- Customized checks with free monograms, accents, and type style

Contact us for more info.

IRA Accounts

H&E IRAs do not have time limitations; they are run as "super" savings accounts and always pay the highest rate of interest of any H&E accounts. This means you receive our best interest rate and can make withdrawals or roll over monies whenever it makes sense for your finances, withdrawals may be subject to penalties.

H&E currently offers Traditional IRAs, Roth IRAs, and Coverdell Education Savings Account IRAs.

- Traditional IRA

You must have earned income to make contributions to a Traditional or Roth IRA. Traditional IRA contributions are fully tax deductible if you are not an active participant in an employer retirement plan. Otherwise, phase out rules apply. Investments grow on a tax-deferred basis. Earnings are taxed on withdrawal.

The annual limits apply to Traditional and Roth IRA's. The current annual limit is $7000.00 if you are under 50. If you are over 50, you may contribute $8000.

Traditional IRAs may be funded until you reach the age of 73, after which you must begin withdrawals. Required minimum distributions are based on life expectancy and the balance of the IRA on Dec. 31 of the prior year. You may withdraw from the IRA without penalty after you reach the age of 59 ½. Distributions prior to that age are subject to a 10% early withdrawal penalty by the IRS with certain exceptions.

- Roth IRA

As long as you have earned income, you can establish and contribute to a Roth IRA, even after age 73. While contributions are not tax deductible, contributions and earnings can be withdrawn tax free, and unlike traditional IRAs, you are not required to begin taking required minimum distributions after reaching age 73. You can convert your Traditional IRA to a Roth IRA to enjoy later tax-free withdrawals, but the amount you convert is subject to income tax now. Also, individuals can make a full contribution if their modified adjusted gross income (MAGI) is under $150,000.00 and couples filing jointly can if their combined MAGI is under $236,000.00. The contribution starts to phase out as income increases above the thresholds.

- Coverdell Education Savings Accounts

ESAs allow you to put money away for higher education expenses. While there is no tax deduction for amounts contributed to an ESA, earnings grow tax free. Max Contribution is $2000.00 annually, amounts are phased out for individuals earning over $110,000 and couples earning over $220,000. No contributions are allowed to the account after the beneficiary reaches the age of 18.

- Catch-Up Contributions

Individuals who have reached age 50 by the end of the year can make additional "catch-up" contributions of $1000 per year.

Please contact the credit union for additional information 201-845-6876 .

Visa Debit/ATM Card

H&E's VISA CHECK CARD gives you convenient access to your account from virtually anywhere! It does all that an ATM card does and more. For ATM withdrawals, use any ATM machine displaying the Plus or Accel logo. You can also use the VISA Check Card to make purchases whereever VISA is accepted. You can pay for gasoline, groceries, apparel, dinner, mail orders, or phone purchases.

H&E's VISA CHECK CARD gives you convenient access to your account from virtually anywhere! It does all that an ATM card does and more. For ATM withdrawals, use any ATM machine displaying the Plus or Accel logo. You can also use the VISA Check Card to make purchases whereever VISA is accepted. You can pay for gasoline, groceries, apparel, dinner, mail orders, or phone purchases.

When purchasing up to $1000 of merchandise, you can pay with "electronic" money instead of carrying large sums of cash. No more "I forgot my checkbook!" All transactions are immediately debited from your checking account, which is reflected in your monthly statement.

Use your H&E Debit Card to:

- Make withdrawals of up to $500 in cash per day from an ATM machine

- Purchase up to $1000 of merchandise per day from any participating merchant

- Make inquiries on Checking or Savings

Convenience, security, and ease of use. Just remember that the amount is automatically deducted from you H&E checking account.

Travel

Please let us know when you're traveling abroad so we won't be surprised when you use your cards outside the US. If we don't know you're traveling, we will deny purchases you make outside the US to protect your card, and you'll have to call us to authorize them.

Please make sure your address/phone information is current. Our fraud department will contact you directly if suspicious activity occurs on your account.Lost or Stolen Debit / ATM Cards

**If you have lost your VISA DEBIT / ATM Card, notify the credit union at once by calling: 201-845-6876.

**If the credit union is closed, notify VISA directly by calling: 800-554-8969.

Also call the credit union on the next business day to reorder a new card number.

Direct Deposit

Social Security encourages electronic deposit and makes it easy to start. Just call Social Security's toll-free number weekdays from 9am to 7pm — 1-800-772-1213. Have your social security number handy along with a personal check or statement. If you do not have checking, you will need to call the credit union for our routing number.